►Table of Contents

Introduction

If you ask a person on the street what your receptionist does, there’s a chance their answer is “talk on the phone.” However, you know the many hats your receptionist wears and the crucial role your receptionist plays in the success of your practice.

A receptionist is the face of your practice, a detective, and your gateway to financial success. So how can you be sure your receptionist is effectively answering the call?

We’re going to look at two key components of your receptionist’s role in the success and growth of your practice: their roles in wound care and insurance verification/payments.

Part 1: Your Receptionist’s Role in Wound Care

The Face of the Practice

Receptionists are the first and last contact your patients have with your office. Your receptionist must always answer the phone with a smile and a cheerful tone. They must show concern and empathy for everyone they encounter – from patient to pharmaceutical representative.

Receptionists must also stress the importance of coming in for wound care appointments. If a patient does not feel welcome, they will not schedule an appointment or visit your practice.

Detective

Part of a receptionist’s role is playing a detective when it comes to triage in your office. They must decipher who needs to be seen quickly and who can’t be helped. While this may not be a challenge for most of your nurses on staff, many receptionists do not have formal medical training.

To better support your receptionist, plan some time to sit down with them and go over important keywords or phrases. Start with the most common and list out keywords or symptoms that help your receptionist know how to triage and schedule patients accordingly.

When your practice performs wound care, it’s vital that you see your wound care patients within 24-48 hours. Your receptionist should have a basic understanding of wound terms and phrases. You want to make sure that you are seeing actual wounds and not scrapes or “sores” that are really calluses.

If it’s too much of a challenge (or time doesn’t permit) for your receptionist to learn medical terminology, you can simply train them how to ask clarifying questions! If you have access to HIPAA-secure messaging, asking a patient to send a photo is a great way to assess the situation.

Part 2: Your Receptionist’s Role in Insurance Verification and Payments

Create a Script

Did you know that two of the biggest sources of lost revenue for a practice come from:

- Not collecting from patients at the time of service

- Not knowing if patients are eligible for certain procedures or supplies.

Many physicians fail to recognize that a receptionist can make or break the financial success of their practice.

The practice can quickly lose revenue if a receptionist fails to gather insurance information, authorize visits, or collect against deductibles. Wound care is procedural in nature and goes against the patient’s deductible. It is not enough to just collect co-pays. An adept receptionist is well-versed in all aspects of documentation and can still do their job with grace and a positive attitude.

You can set clear expectations by creating a script for your receptionist that allows them to show empathy, schedule correctly, and collect important information.

Use the following phone script example…

Example Phone Script

“Thank you for calling __________. How can we help you today?”

“What can Dr.________________ help you with?”

“What’s your name?”

“Which foot is bothering you?”

“Where exactly does it hurt?”

“How long has it been bothering you?”

“What have you done so far to help it?”

“Are there signs of infection? In other words, is it red, hot, or swollen?”

“I am so glad that you called our office, Mr./Mrs. _________________!”

“Dr. __________________ specializes in ____________________ . We can get you in on ____/____/____ and get that____________________ resolved quickly.”

“Do you have insurance that you would like us to process on your behalf?”

“Can you please tell me your policy number, so we can check the benefits for you?”

“Great! We are in-network with that insurance plan.”

“Mr./Mrs. _________________ , you will still be responsible for your in-network co-insurance, co-payments, and deductibles at the time of service.”

“We look forward to seeing you Mr./Mrs. _________________ at (time and date of their next appointment).

Welcome to (name of your clinic)! I know you will get the help you will need here.”

Insurance Verification

It is essential that your office knows the patient’s insurance deductible obligations, insurance copay/coinsurance due, and whether they have coverage for other services your office provides like orthotics, surgery, and wound care supplies.

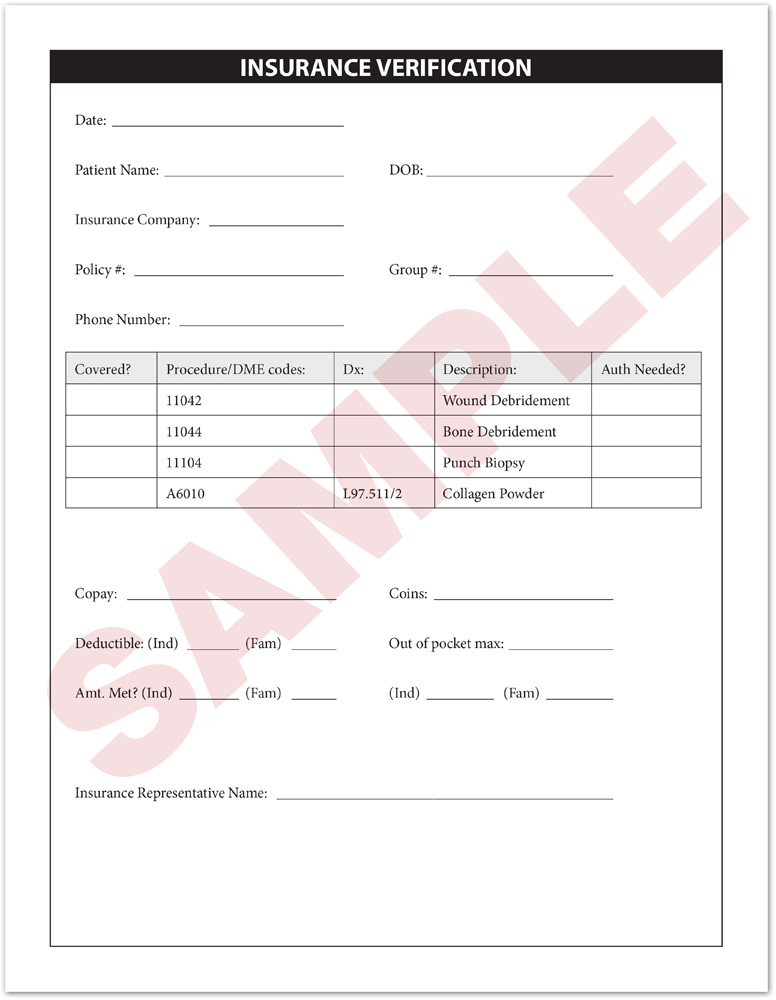

While it is usually easy to find co-pay and deductible information through your Electronic Medical Records (EMR) or Availity portal, a phone call is generally required to find out if your patient has benefits for durable medical equipment (DME), surgery, and/or wound care supplies. Most practices use a standard form, like the one pictured.

Detailed insurance verifications is the key to reducing confusion for you and your patients. Your receptionist should perform these for every new patient and on a yearly basis for returning patients.

Your receptionist should check for copays and deductibles, and also for coverage for common Current Procedural Terminology (CPT) codes for which your office bills.

Collecting Deductibles & Co-Insurance

If you do not know what your insurance companies reimburse, use the Medicare fee schedule for a good estimate.

If payments are not collected at the time of service, you will be billing the patient and hoping that you will get paid.

Conclusion

It is essential that you train your staff to get accurate insurance information, check the insurance benefits, and collect the correct payment from the patient at time of service.

Taking these steps will help you achieve financial success in your practice. If you have further questions about Amerx wound care dressings, insurance forms or would like to speak with an Account Manager about our doctor and patient direct programs, please call (800) 448-9599 or email .